Australians who face devastating property losses following natural disasters such as the recent floods confront further hardship when trying to claim on their insurance because of confusing terms and conditions and fine print limitations in their policies.

A new report commissioned by Financial Rights Legal Centre has called upon the Australian Government to simplify and standardise key insurance definitions used in home building and contents insurance – including storm, fire, wear and tear and malicious damage – with a focus on regulating the fine print used to exclude and qualify terms.

The report Standardising General Insurance Definitions by Dr Diana Grace PHD and Professor Michael Platow PHD examines a lack of consistent definitions in general insurance and the impact this is likely to have on the implementation of the Australian Government’s Consumer Data Right reforms to general insurance.

The actual terms and wording used in the Product Disclosure Statements (PDSs) of the home insurance policies of 34 insurers in Australia were examined and a series of focus groups conducted to explore consumers’ understandings of these terms, and related concerns.

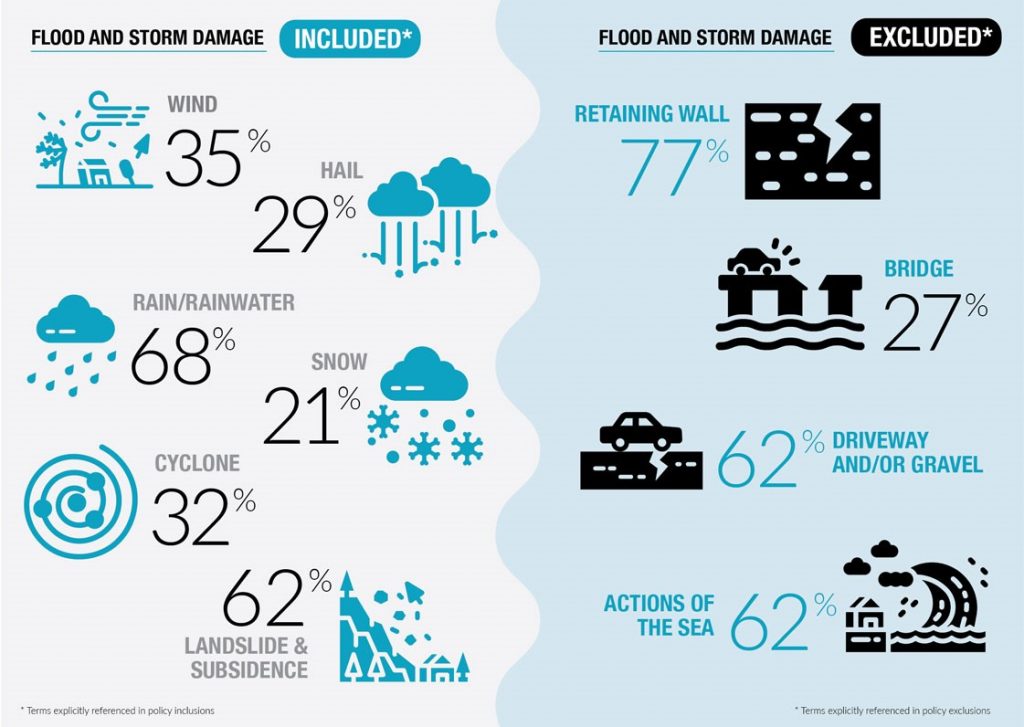

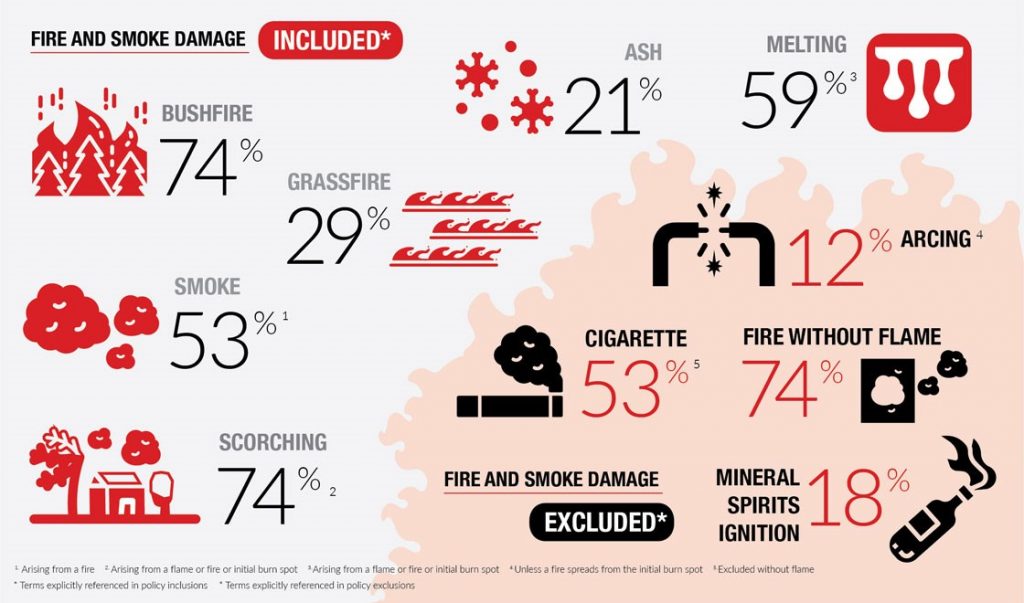

Director of Casework at the Financial Rights Legal Centre s Alexandra Kelly said Australians like those who have faced recent storm, rain and flooding events in south-east Queensland and northern NSW buy insurance to protect themselves from the risk of catastrophic extreme weather events. However Ms Kelly says there are significant differences in how insurers define in flood, storm, fire and smoke damage. This makes it extremely difficult for consumers to understand their policies and what they are covered for.

“At claims time policyholders are too often surprised to find they are not in fact covered because the fine print in insurance policies excludes damage from wind, or hail or even rainwater runoff,” Ms Kelly said.

“Every day people know what storms, fires and floods are. But what people often don’t know is that multiple fine print, exclusions and qualifications alter the meaning of these basic concepts. Even the term ‘flood’ - which is already standardised - has been altered by one insurer and packaged with ‘rainwater run-off’.

“This is bad news for a large numbers of policyholders in Queensland and NSW who have inadvertently opted out of ‘rainwater runoff’ because they opted out of ‘flood’ cover.”

A lack of consistency in definitions and use of key terms in general insurance hinders the ability of consumers to compare insurance products and could be a significant barrier to the effective application of the Consumer Data Right to the general insurance sector, Ms Kelly said.

“The Australian Government must act to ensure the policies and practices of insurers do not undermine the objectives of ‘open insurance’,” she said.

The report recommends that special attention be given to standardising terms used to exclude and qualify insurance cover in an easy-to-understand tabular form.

“This would assist consumers to compare insurance policies. It would also assist industry and governments to better assess the community and economic impact of extreme weather events and manage disaster response.

“The prevalence of underinsurance and non-insurance can hinder the recovery efforts of communities and governments following natural disasters.”

Read the full report.

Other Financial Rights publications: https://financialrights.org.au/publication/

Background

Standardising General Insurance Definitions is the third report in our Future of Insurance series.

The first report Open Insurance and Consumer Data examinedthe potential consumer benefits and risks associated with an improved ability to access specified data held about them by insurers, and to authorise the secure disclosure of that data to third parties.

The second report Automating General Insurance Disclosure examined close to 400 cases of Australians being denied insurance claims for not fully disclosing relevant information and whether Government should enable the pre-filling of Australians’ driving records and insurance claims history information required for disclosure purposes.

Standardising General Insurance Definitions was produced with grant assistance from Ecstra to examine - from a consumer’s perspective - the future of insurance and the new concept of Open Insurance - the application of the Consumer Data Right to the insurance industry.

The CDR will provide insurance consumers with the ability to efficiently and conveniently access specified data held about them by data holder insurers, and to authorise the secure disclosure of that data to third parties (accredited data recipients) or to themselves.