Contents

- Financial Rights welcomes new Chair and additional directors

- National Consumer Advocacy Award joint winners (again!)

- Revised Banking Code approved – with no enforceable clauses

- Desktop audit of Life Insurer family violence policies finds big disparities between insurers

- Mob Strong visits East Arnhem and finds superannuation issues rife

- Housing stress is biting – and lenders are on notice they must do hardship better

- Youpla Support Program

- Recent submissions

1. Financial Rights welcomes new Chair and additional directors

In April, Natalie Pozdeev became Chair of Financial Rights, as Peter Kell moved into his new role of Inaugural Chair of the Financial Counselling Industry Fund. We thank Peter for his leadership and warmly welcome Natalie to her new role.

Rosie Thomas and Sue-Ellen Hills joined Financial Rights as directors in June.

Rosie leads Choice’s Campaigns and Communications department, which fights to keep industry and government accountable and achieve real change for Australian consumers. She was previously Deputy Director of Choice’s partner organisation Super Consumers Australia, and has experience as a lawyer, regulator and policy advocate.

Sue-Ellen Hills joins us as a First Nations Board member. Sue-Ellen is a senior solicitor at Legal Aid NSW, whose legal career has been focussed on supporting people who need it most. She brings a wealth of knowledge about First Nations legal issues, and has led Legal Aid NSW’s work in the aftermath of the ACBF/Youpla collapse.

We are thrilled to add Rosie and Sue-Ellen’s expertise to the organisation.

2. National Consumer Advocacy Award joint winners (again!)

Each year the Consumer Federation of Australia’s bestows the National Consumer Advocacy Award, in recognition of the best consumer advocacy campaign or project of the year. Financial Rights was part of a campaign that jointly won the award.

This year’s joint winners are:

- ‘Weathering the storm: Insurance in a changing climate’, a joint report from CHOICE, Climate Council, NSW Tenants Union, Financial Rights Legal Centre and Financial Counselling Australia and

- The Designed to Disrupt report series, by Flequity Ventures and the Centre for Women’s Economic Safety.

As always it is a delight to be acknowledged, and for our work to be recognised alongside such incredible campaigns.

3. Revised Banking Code approved – with no enforceable clauses

The Australian Securities and Investments Commission (ASIC) recently approved a new version of the Australian Banking Association’s (ABA) Banking Code of Practice, which will commence on 28 February 2025.

Financial Rights and other consumer advocates were involved in protracted negotiations with the ABA over a four year period to maintain many of the fundamental consumer protections in the Code. Advocates made multiple submissions, attended dozens of consultations, took part in an additional consultation with ASIC, and pushed back hard against attempts to claw back oversight of the Banking Code Compliance Committee (BCCC) of key protections for bank customers.

After sustained advocacy, we have been successful in ensuring the Code maintains key clauses the ABA sought to remove due to claims of duplication. This includes some of the cornerstones of the Code, like the “diligent and prudent banker” clause and the complaints section.

Other minor improvements to the Code include:

- Amendments to the interpreter clause – to ensure that banks try a few times to engage an independent interpreter

- A new deceased estates commitment, and

- Stronger enforcement and compliance provisions in the BCCC section.

The ABA did not nominate any clauses to be enforceable by statute, and ASIC have approved the code with no enforceable clauses.

This is a disappointing outcome. The enforceable code regime that was introduced after the Royal Commission has so far not delivered at all on its intended purpose – to improve the enforceability of Codes for the benefit of consumers. The Banking Code is at least enforceable by contract and is the only Code approved by ASIC. It will be interesting to see if any other industry sectors step up to seek approval of their Code, and whether in the process, they will put forward any enforceable code provisions or seek to make their Codes also enforceable by contract.

The question now is whether the enforceable regime should be reconsidered entirely, and what is the best path forward to have strong enforceable commitments under all Codes that cover the field in all relevant sectors. We note that there is still no code for the superannuation industry which is a real gap – see article about Mob Strong outreach below.

4. Desktop audit of Life Insurer family violence policies finds big disparities between insurers

Since the launch of the 1 July 2023 Life Insurance Code of Practice, insurers have been obliged to have a publicly available policy on their websites outlining how they will support people impacted by family violence.

To support the development of these policies there is an FSC Life Insurance Family and Domestic Violence Policy. This is an aspirational document, which does not bind insurers, and does not have legal force.

Financial Rights undertook a desktop audit of life insurance family violence policies as they existed in August/September 2023, to benchmark all Life Insurance Code subscribers against the Family Violence and Domestic Violence Policy and to encourage ongoing improvements to their family violence policies.

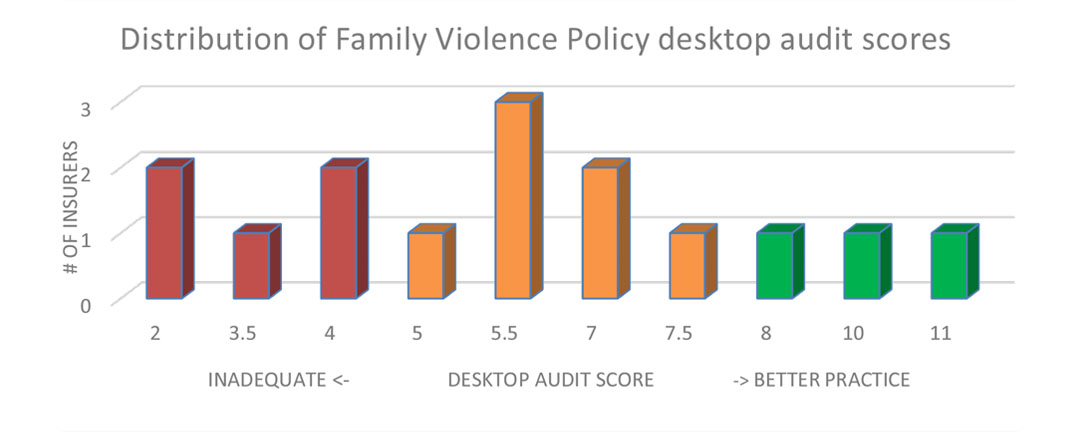

Our assessment found that insurer family violence policies varied considerably in meeting the 11 areas that a policy “should” have. Only one subscriber of the 17 surveyed was found to have a policy that addressed all 11 code clauses. Disappointingly, a little over half the subscribers scored 5.5 out of 11 or less.

We want insurers to learn from each other and adopt best practice family violence policies. To this end, we recommend that Life Insurance Code subscribers should:

- adopt the approach of the Noble Oak policy which sets out why each of the 11 areas are important and puts specific measures in place to address each issue: see commentary under Noble Oak in Appendix A; and

- in addition, include the following specific commitments found in other subscriber family violence policies that provide further protections for vulnerable consumers:

- for safety reasons, include a large button to navigate quickly to another website: see the Allianz, Resolution Life1, and TAL policy;

- specifically state that employees will be supported if vicariously impacted after helping affected customers: see the AIA, Allianz, Metlife, Resolution Life and TAL policies;

- do not require notification to the police about a perpetrator of family or domestic violence: Noble Oak and Resolution Life.

The full desktop audit released in May 2024 is available in the Publications section of our website.

In our role as a member of the Economic Abuse Reference Group, Financial Rights also recently gave evidence to the Parliamentary Joint Committee on Corporations and Financial Services inquiry into financial services regulatory framework in relation to financial abuse. You can read our submission to the inquiry here.

5. Mob Strong visits East Arnhem and finds superannuation issues rife

In June 2024, the Mob Strong Debt Help Team went on outreach in East Arnhem land. We visited three communities to talk about our services and provide some help to mob on their various needs.

Visting country is always a reminder of the additional barriers to accessing help experienced by people in remote areas.

Distances are vast, and it takes a long time for people to travel between communities. Travel is only possible with a 4WD vehicle – and only when it’s not in the rainy season. It can be nearly impossible for people in this region to do something many of us take for granted – get to the nearest bank branch when they need to do a transaction in person, or go to their local Centrelink office to talk to someone about their needs.

It was also a stark reminder that the continuing shift toward digital service provision – which requires access to individual electronic devices, internet coverage, and digital verification – does not reflect he reality of living in remote areas or in community.

Of all the recurring problems we heard from mob, the most persistent were problems accessing superannuation funds. Many people were not able to find where their super was, or how to access it. We encountered several barriers with different super funds to try and help these people, who were sometimes denied access to their own account because of a small administrative mistakes made by the employer, or the fund itself.

There is real gap between consumer needs and what is currently provided, and super funds need to step up and introduce culturally competent member teams and better access points for First Nations members. Mob Strong will continue to advocate to make sure funds conduct frequent and meaningful engagements with their First Nations members.

6. Housing stress is biting – and lenders are on notice they must do hardship better

Calls to the National Debt Helpline are once again increasing, with housing stress – for both mortgage holders and renters – the single biggest issue being reported across the county. Over 145,000 calls were made to the NDH last financial year. Disturbingly, in New South Wales the number of callers experiencing mortgage hardship has almost tripled from this time last year. Some callers have very large arrears, making is difficult to set up hardship arrangements with their banks that work over the long-term. Callers are telling us their lenders are offering very short term and inflexible hardship options.

And yet ASIC recently warned lenders they need to improve their hardship practices, after its investigations showed lenders failing in their obligations that resulted in poor outcomes for many customers. We are keeping a close eye on lender hardship practices.

The Mortgage Stress Handbook has been updated and provides practical and detailed guide for people who need help. Our financial stress web advice and fact sheets are also frequently updated and can be a helpful place to direct people who are able to self-advocate.

7. Youpla Support Program

The Youpla Support Program launched on 1 July 2024.

Mob Strong’s Youpla page is being updated as information becomes available, so please check that page for the most up to date information.

8. Recent submissions

Financial Rights publishes our submissions to public inquiries and consultations. Recent submissions include: